- Corporate Activity

- Investment Philosophy

- From Investment to IPO

- Fund Operating Policy

- Effective Fund Management

Aproach

The first step is to make contact with a promising venture enterprise. In addition to making our own approaches, there are many occasions on which FVC is approached by venture enterprises. By cooperating with key players in regional economies, such as local government bodies and financial institutions, we have strengthened our network and encouraged other parties to introduce numerous promising enterprises to us.

Screening

Screening Process

For those enterprises which accord with FVC’s investment philosophy, we will commence the actual screening process. This will be conducted chiefly by the investment officer in charge together with his senior investment officer and usually takes three months.

During screening,

- 1. Frequent, detailed talks are held with the president and management team to gain a clear grasp of the enterprise’s history, substance, strengths, weaknesses, and aspirations, and to evaluate its potential, business plans and other documentation are scrutinized and industry experts consulted. In addition, a short review is executed by an outside auditor, and thus the current state and future potential of the enterprise can be accurately understood.

- 2. After the examination by the FVC officer in charge and his senior investment officer, an internal review is conducted. In this internal review,

・Examination centers on a broad range of documentation.

・The review committee, comprising several investment members, fully evaluate the enterprise.

Thus, the prospective portfolio company is examined and scrutinized thoroughly. - 3. When these examinations are completed, a final examination is conducted by the Investment Committee. After a presentation is given by the president of the enterprise under examination, a final decision is made on investment based on the accumulated results of the screening process.

Screeming Process

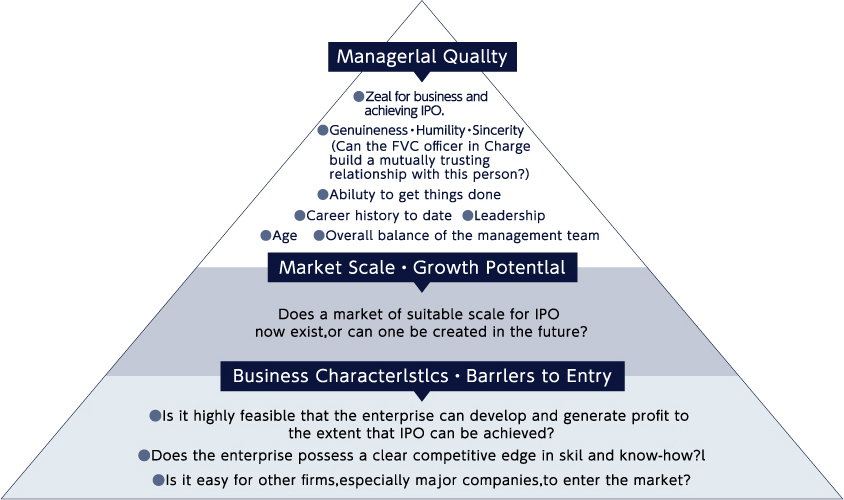

(2) Points valued in examination

That an enterprise is ultimately seeking to list is a major premise for the screening process to begin. On that basis, critical points to achieve listing are examined, starting with the manager’s quality, and including the scale and growth potential of the market, business characteristics, and barriers to entry. In addition, serious consideration is given to whether management of the enterprise is sufficiently robust to become a listed company, or whether it can attain such a level in the near future.

Point that FVC values

(3) Submitting material necessary for the investment examination

Various documents (business plan, financial statements etc.) necessary for conducting the above-mentioned investment examination are to be submitted to FVC.

Inventment

After a decision is made to proceed with actual investment, an investment contract is concluded, setting out the use or destination of the funds and a schedule leading to eventual listing. After investment, the use of the funds and the progress toward listing are monitored.

Support

To achieve an on-schedule market listing, close support is provided to the enterprise’s management in various ways. Namely, FVC leverages both its in-house expertise and extensive network to introduce various players, including financial institutions, brokerages, auditors, business partners, and even customers, in order to contribute to adding corporate value and improving such business aspects as strategy, decision-making, corporate governance, disclosure, and the like. Moreover, we make regular visits on-site and participate actively in various meetings to maintain close communication with the enterprise’s management.

Exit

Once listing is achieved, stock can be sold off at any time as needed. In addition, when it is not possible to achieve listing within the fund’s term limit, stock is sold off. In such cases, we endeavor to ensure that an amicable relationship is established between the enterprise and new stockholder.